by Karen Skidmore | 02,22 | Business Planning, Team & Hiring

Having a good Virtual Assistant (VA) to support you in your business is an essential first step to building your support team and releasing yourself from the trap of being a busy freelancer. Not only does a good VA free you up from day-to-day admin tasks, they also give you the opportunity to position yourself better; just as a lawyer, dentist or private doctor would have a receptionist or personal assistant to take care of enquiry forms, appointment booking and follow up documentation.

However, there is a stage in every business journey where you have to review whether you have the right team members to support your forward growth; not what you need right now, but what you need to go to the next level.

Your VA, no matter how good they are right now, may not be meeting what your business needs to level up. No fault of their own, but you, the business owner, haven’t got the time or energy to delegate effectively and important projects aren’t getting done.

You have reached capacity and you’ve taken on a freelancer mindset again, trying to do too much yourself. You have become the bottleneck in your business.

Has it become time to review who is in your support team and think about hiring an Operations Manager?

Over the years, we have helped many of our Momentum members shift their thinking and take the right action to up-skill their support teams. But last year, I could see that I needed to walk my own talk.

Although we had a great couple of years, especially as Melina Abbot joined me as a Senior Coach in my Momentum programme in 2018, in the second half of last year I saw that I had become a busy freelancer again. I had become that bottleneck in my business!

It was time for me to invest in my team, and one of the big lessons of now having gone through this process myself, is that I really should have done this six months earlier.

Alexia had already been working with me for 13+ years as my Virtual Assistant. Over the years, Alexia has grown in confidence on what projects she could take on and has been instrumental in creating robust and elegant onboarding processes and client management, which has hugely contributed to the success and retention of our Momentum membership. At the end of last year, I offered her the promotion of both upping her hours, and upping her level of responsibility and contribution to the business, and I am delighted she is now our Client & Operations Manager as of the start of February.

But when is the right time to hire an Operations Manager?

Should you be worried about the additional costs of hiring someone more than a VA? And do you really need an Ops Manager if all you want is a small, easy to run business?

Let’s dive in and answer these questions.

What is the difference between a VA and an Operations Manager?

The core difference is how strategic their role is. A VA typically takes instruction from you and is task driven; you decide on what tasks need doing and they do them for you. Of course there are plenty of VAs who take on project management and higher levels of responsibility, but not all VAs make for good Ops Managers.

An Ops Manager will typically manage the systemisation and scaling up of your business, as well making sure your business runs efficiently and effectively. They become accountable for outcomes and take a longer term approach to success, rather than just ‘getting stuff done’.

There are also Online Business Managers (OBM) who specialise in working on your digital strategy, marketing funnel systems and e-commerce processes. It really depends on what kind of business you are running so for the purposes of this article, I am including OBMs in this Ops Manager discussion.

When is the right time to hire an Operations Manager?

My answer to this question is always ‘three months from when you need them’.

The mistake I see so many business owners make is to leave hiring someone at this level too late. That was almost me. I had already laid down the intention to Alexia that I would love to hire her for more hours and increase her responsibility, but I spent the next six months with the mindset of ‘when XYZ happens, then I will be able to promote Alexia’.

It wasn’t until I saw how certain projects weren’t happening that I knew I had to flip this over to ‘when I promote Alexia, then XYZ will be able to happen’.

To see the real results from hiring someone at this level, you have to give yourself and them at least three months. Yes, someone can come in to fire-fight their way through certain projects, but these aren’t the best conditions for someone working strategically on your business. There is every chance they will burn themselves out focusing on task management and getting stuff done, and not have the space or energy for strategic thinking to make your business more efficient and effective and/or to up level.

Reviewing your business every quarter (or trimesterly planning as we do in Momentum) is critical to helping you see the opportune time. Here are a few red flags that you may recognise in your business right now:

- Your business development has stalled; you are too busy dealing with your current clients and the number of leads coming in are dropping.

- A number of ‘love to do’ projects have piled up because you haven’t had the time to plan out and execute them; projects such as that new podcast, or write that book or market yourself as a speaker.

- Your VA has started to irritate you; they were wonderful to begin with but now you’ve grown and the business is busier, you wish they would be able to use their initiative and come to you with solutions, rather than more questions for you to find the time to answer.

- Your VA can’t cope with the marketing funnels or digital course platforms you’ve created over the past year; they are doing their best to do what you ask, but it’s becoming clear that although they’ve been good at building what you need from the ground up, the systems and processes aren’t integrated and your business is feeling over-complicated and messy.

- You are spending too much of your time looking for documents, passwords or emails from key clients; you’ve even realised that several of your clients haven’t paid you but you’ve been too busy to chase them.

Now, of course, these red flags could mean all sorts of things; not just that you need an Operations Manager. But what you need to realise is how important it is for you to be thinking ahead and plan, hire and on board someone at this level BEFORE you get so busy fire-fighting that it makes it very difficult for you to have the time to go through this process.

Longer term thinking is needed and by deciding what you feel you need in your business one year from now, you will allow yourself to proactively plan ahead and avoid any of the red flags listed above.

How do you deal with the additional cost?

This one is a real doozy! Yes, it is a risk hiring someone that may double or even triple your current team costs, but here’s another way of asking this question …

How can you afford to not up-skill your support team?

If you need to motivate yourself, work out how much all those red flags above could cost you each month. And not just in lost revenue. There’s also the cost to your health and family if you are working more hours and stress than you can cope with right now.

To avoid getting stuck with this question, work out the cost of the first three months of hiring, and only look at this figure.

If you work out annual costs, and then look at your current revenue, it could be super scary. You have to remember that one of the key reasons for hiring someone at this level is that you are looking to grow and scale. If you are not freeing up your time to create opportunities to increase your revenue, then it may not be the right move for you (see below my answer to ‘Do I really need an Ops Manager?’).

Know the cost of those first three months – their initial probation period – as this is your core financial risk. If the person you’ve hired does not meet your expectations or deliver on what it is you want from them, then let them go. Don’t keep them on and pay any more in the hope that they ‘make good’ eventually. This way, you’ve only spent three months of fees, you’ve reduced your long term spending risk, and still probably gained a whole load of leadership lessons (which we could argue could be worth the money spent!).

Do you hire them on payroll or as a contractor?

First off, this is a legal question and needs to be addressed according to which country you are based. Here in the UK, we do have strict IR35 rules (I’d recommend you read them all through here on the gov.uk website).

As a basic rule of thumb, if you stipulate certain hours and days that need to be worked (ie Tuesday to Thursday 9 to 5) and you are their majority source of income, you are legally obliged to have them on payroll. And there is nothing scary about putting someone on payroll. I hired a part time Marketing Assistant many years ago on payroll and it was super simple as my accountant ran the payroll and I used all the legal contracts needed from Suzanne Dibble’s amazing Small Business Legal Academy.

If you are one of several clients they work with and you don’t stipulate hours, hiring them as a contractor/freelancer may give you a more flexible or easier option to get going with. Discuss this with the person you want to hire as they will be able to help with this if they are already working in this capacity with other clients.

Can I just give my current VA more responsibility?

Absolutely, but ensure you take the time to plan out exactly who you need and what responsibility you want them to take on. Although you may not need to do a formal interview process, you do need to talk through the new role and ensure they have the skills and qualities to fulfil your expectations.

Don’t just take the easy route and assume they can level up. Maybe you need to invest in their training and development if you feel they are the right fit for your business, but they currently lack the necessary skills. It’s often cheaper to invest in the people you have because of their knowledge of how your business runs and what your clients expect from you, then it is to try to buy in the new skills. So do consider this as an option.

Do you really need an Ops Manager when all you ever wanted was a small, easy to run business?

If your business is still under the VAT threshold or your revenue is running less than an average £5K/month, then a VA with a focus on systems and processes may be all that you will ever need. You don’t want to be ego-driven in this process, thinking that having an Ops Manager is what a successful business “should” have.

You don’t want to be over-resourcing your business and have unnecessary team costs eating into your profits, so understanding what your longer term growth strategy is important here. Scaling for the sake of scaling can unnecessarily over-complicate your business and end up being exhausting and expensive!

If your business is heading towards or already well into 6-figures, then investing in someone at the Ops Manager level can pay dividends, especially if you want a small, easy to run business.

So the real answer to this question is ‘it depends’; it depends on your ambitions, your life goals and how much time, freedom and energy you want in your life.

I believe your business is there to serve your life and leadership goals (rather than for us to be chasing business goals and getting trapped in a business that keeps us busy for the sake of being busy!). These are the kinds of decisions we help our Momentum members with regularly, so if this longer term strategic thinking is the kind of support you know you want for your business, then get in touch and we can talk through your options.

How do I go about hiring an Ops Manager?

There are several steps you have to follow to ensure a successful hiring process and long term relationship.

1. Write a job specification; what do you need them to do, what qualities does the person need to have, what are the opportunities you are can offer them

2. Go through a proper hiring process; don’t just hire friends or relatives, but nor do you have to use a recruitment agency. Use your current network, LinkedIn and even your current VA to help you spread the word. Set up interviews, including practical assessments if that is needed to give you the evidence that they are as good as they say they are. And remember references or ask to speak to some of their current clients.

3. Have contracts & service level agreements in place; again, I use Suzanne Dibble’s SBLA for all these. Don’t hire someone – payroll or contract – without the necessary paperwork and have it all confirmed BEFORE you begin working together.

4. Set them up for success; have a growth plan for them to work from, set out clear success metrics that they know they need to work towards to get the results you expect, and establish a plan for how you are going to communicate each week. These need to be done in partnership because this is how you start to wean yourself off the ‘I have to be in control of everything’ and allow them to do the job that you’ve hired them to do.

5. Review meetings; to ensure you are delegating (and not abdicating!) have a weekly Monday project meeting, a higher level monthly review meeting and an end of probation review to decide on your ongoing relationship.

6. Document, document, document; this should be second nature to a good Ops Manager, but make sure everything you both decide and take action on is documented. This is not only good practice for your whole business, but if you ever have to go through the hiring process again, you are not starting from scratch.

What other questions do you have?

Is there anything else you feel you need to do before you begin the process of hiring an Ops Manager?

It is easy to get caught up with all the ‘how do I?’ questions and then not take any action. The truth is that hiring an Ops Manager is just like anything we do successfully in business; it’s 80% mindset and 20% practicalities. In our Momentum programme, we go through in detail the steps and give you the confidence and support you need to ensure you hire right first time, so if this is something you know you want, check out our programme here.

I know I couldn’t have done what I have done in my business without my small, but very beautiful team. And I have always felt it to be important that they are invested in my business and in the success of my clients, as much as I am. So if you are sitting on the fence of whether you are ready to up-skill your support team, I encourage you to take the first step; write that job spec and then start having a few conversations.

Let me know in the comments below how this article has helped you.

Until next time, do less, be more, play bigger.

by Karen Skidmore | 12,21 | Business Planning, Stories, inspirations & thoughts for the day

It is said that the lessons we *really* need to learn in life, show up time and time again. We don’t learn it once and be done. Life has a way of circling back and giving us another experience or challenge to navigate to make sure we *really* get the lessons.

Many repeated lessons come to us on a superficial level to begin with. We may logically get what we’ve experienced for the first time but it’s through repeating the lessons that we truly see the importance of why certain behaviours and beliefs have to change in order to fulfil our potential.

So it is no surprise to me that the four biggest lessons that have helped me shift forward this year have all been learnt before. I just got to experience them a deeper level, and yes that did mean slightly messier at times, too LOL

Slowing down speeds up success

No matter how much I know this, I keep on having to learn it because it seems I am still not going slow enough. But the slower I make decisions and the more I feel into them, sleep on them and trust my gut, the stronger and more powerful the results I get.

Once upon a time, a mentor told me ‘money loves speed’. I took this to heart and prided myself on my fast decision making and product launches. But what I have come to realise is that the longer the time I take to plan and sit with new ideas, success becomes simpler and easier.

And the deeper level of learning of this slowing down has helped me know when it’s not procrastination or me playing small.

Underestimate what you can achieve in a day, and overestimate what you think is possible to achieve in a year

This is one of our Momentum ‘bumper stickers’. Even though this gets repeated and repeated on our calls and I give out this advice like candy, it’s still so easy to believe that I can take superhuman powers on certain days and crazily multi-task when faced with a to-do list the length of my arm.

And yet, when I sit with my bigger vision work and feel into what it is I want to create in a year’s time, I have to consciously stretch myself beyond my current resources and thinking.

Plans may not work but it’s the thinking that goes into your planning that matters

Every time I make a plan, I’ve continued to learn that I need to keep it bold, but loose enough to flex and adapt with what each month brings. Just because almost all our holiday plans are now rescheduled (yet again!) for 2022 (our Ibiza trip has been rescheduled three times now), this doesn’t mean I can’t set targets or milestones in my business.

I’ve had to remember to stay unattached to the outcomes that I set, and to always add the phrase “or better” to each one. Because it’s not the plan or the targets that are important; it’s the thinking that’s needed during the planning process.

This is what expands my mind to see the possibilities and to let my doubts keep me grounded whilst still shooting for the moon and be able to land somewhere in the stars.

And finally, health is everything.

I took several weeks out during the summer, cancelled things and invested in my health. Even though I thought I was doing OK, to have some test results come back with ‘early signs of autoimmune’ was a reality check that I needed to get on the right supplements, change up my diet and work in more exercise.

I am finishing this year feeling stronger than ever, and even taken up a twice weekly kick-boxing fitness class which I am absolutely loving.

So what lessons have you learned this year? And how many have you learned not just once before, but maybe many times over?

Until next time, do less, be more, play bigger.

by Karen Skidmore | 11,21 | Business Planning, True Profit

If you are struggling with the thought of VAT registration, you need to read this.

Perhaps you have a fear of losing clients if you have to put your prices up 20%, or you simply don’t know how to approach the whole situation.

You can become VAT registered at any time, but businesses only have to pay VAT once their annual turnover reaches a certain threshold (currently at £85,000 in the UK). A point in your business growth that should be celebrated as you are now officially adding value to the economy, and you are well on your way to achieving that 6-figure status. But unless you registered for VAT right at the start of your business journey, this growth milestone is guaranteed to trip the majority of business owners up, especially if you are selling to consumers, who can’t claim the VAT back.

What ought to be a pragmatic, logical decision, becoming VAT registered can quickly become an emotional storm of over-thinking.

In today’s article, I want to highlight the possible stories you may be telling yourself (stories that probably not true … but affect your decision making), highlight the three choices you have over when to get VAT registered, and then give you a number of possible opportunities for you to move forward so your business growth doesn’t plateau.

First off, I want to share my VAT registration journey because I got stuck here for almost two years. I was finally forced to register for VAT on 1st April 2016 but not getting VAT registered when I set up my second coaching business in 2013 has probably been the only business decision I’ve ever regretted.

If I’d treated it as part of setting up a new limited company back then, I wouldn’t have had to deal with the painful two year experience of waiting until I was forced to register; registering only when I reached the threshold, and not before. When I started my first coaching business, CanDoCanBe, in September 2004, charging VAT wasn’t even part of my thought process. I wanted to keep things simple and my money goals back then were far lower. I was selling to other business owners but most of them weren’t VAT registered themselves.

Over the years, my business grew, but just as I thought about taking my income seriously, I lost my Dad after 18 months of cancer. My business took a back seat and I barely made a profit during those two years. When I came back to work in September 2010, all I could do was to focus on building up my business again … registering for VAT wasn’t on the radar.

By 2014, I had rebranded and started my second business, Karen Skidmore Ltd, and I had found myself getting close to the VAT threshold quite quickly. Although I had been working with various mentors at the time, technically I had all the support to create and build new revenue streams and raise my game. But somehow I never really upped my game sufficiently enough.

The looming VAT threshold had created a number of stories in my head.

I was experiencing the Big VAT Ceiling.

For two years, my business revenue came in at just under the VAT threshold; I couldn’t have worked any harder to have stayed in the same spot!

Having spoken and worked with many business owners at this level of their business, it turned out that I wasn’t alone. The stories I was telling myself about what it meant to be VAT registered, were the same as many others.

The VAT Stories That We Tell Ourselves

We all have stories running around in our heads, particularly around money and pricing. Stories about why certain people buy from us; how certain marketing campaigns work, and others don’t; how much you think people will be prepared to pay you.

These stories aren’t necessarily true or false, but are based around our beliefs and what we’ve seen, heard and experienced. When we are unsure or emotionally connected to an outcome (ie “I have to make the sale to prove that I am good at what I do”), we make what happens (or doesn’t happen) mean something to us. These stories are just assumptions, and never really based on what’s really going on.

Making the decision when to register VAT creates the perfect conditions for such stories, assumptions and over-thinking. Here were the three stories that I had running around my own VAT registration. Which ones do you relate to?

1. My clients won’t pay VAT as so few of them are registered themselves.

If you are selling to consumers, rather than organisations who can claim the VAT back, charging an extra 20% on your prices can feel an enormous hike.

When I was struggling with this, my clients were business owners, but very few of them were VAT registered themselves. I just couldn’t get my head around increasing my fees by 20%, knowing that they couldn’t claim this back.

But VAT is part of our everyday lives. We may not like paying it, but we know we have to pay it. If VAT was included in prices, then we often don’t blink an eye. It’s when you choose to buy, get excited about buying, go to the checkout and then be told “Oh, that’s another 20% please” … that’s when, as consumers, we can decide that something may become too expensive because the price suddenly changes at the last moment.

2. I hate finances – I want to keep things simple.

I love simplicity. But using simple as an excuse not to understand the stuff that would help me shift my business forward, was … well frankly … a crap excuse.

I am never going to try to convince anyone that VAT is simple but as I learnt, you don’t have to be a VAT specialist to get VAT set up. That’s why you have a trusted accountant who you take advice from, and move on.

Plus you really can’t go wrong by reading through the clear steps outlined on the gov.uk website. You just need to make the time to sit down quietly and go through each section.

3. I’m going to lose clients if I put my prices up.

Similar to story number one, but this story threw up all the insecurities I had about my prices. Pricing is one of the biggest mental exhaustions for business owners, especially for those of you who are selling your time and expertise.

Charging VAT immediately puts up your prices by 20% which may well be the biggest jump you’ve ever had to make since starting your business. So it’s no surprise that bubbling up to the VAT threshold throws up all sorts of over-thinking and worries.

Making the VAT registration decision

Registering for VAT is simple compliance. However, if you’re playing emotional head games and you start believing the stories you are telling yourself, you are going to stay stuck here at this revenue ceiling for many years.

There are three choices you can take with your VAT registration.

Choice 1: Do everything possible to NOT have to register for VAT

I hear of business owners wanting to create multiple businesses, so that they trade different products and services through different businesses. I went through this thought process myself. Legally, there are ways of being able to do this; speak to a good accountant and I’m sure you can find all the right loopholes to allow you to do this.

But, what an absolute over-complication of a very simple problem.

The mindset here is coming from a place of scarcity; of restricting how you operate, which in turn can close down all opportunities for future growth. Yes, there may be good reasons why this could work for you, but what if you are faced with the same problem again in a year or two when your separate businesses all start to bubble under the VAT threshold again?!

I’m all for tax efficiency and only paying what you owe, but if you make this choice, it’s like running a race by always looking over your shoulder at your competitors behind you.

Choice 2: Wait until you reach the threshold and you have to register for VAT

This was the choice that I made, and boy did it create stress at the time. For the few months leading up to this point, I was constantly checking to make sure I wasn’t going to get caught out. Always be seeking counsel from your accountant at this point because there are some hefty fines and potential back payments to be made if you decide to ignore this.

At the month we realised that VAT registration was inevitable, I had to quickly put together a letter explaining the situation to my clients that they would be paying an extra 20% the following month. In the end, I handled it all OK, but I created so much stress for myself. I know, looking back, that this was a big distraction and stopping me from working on future growth plans. Registering for VAT not only turned out to be a painless process, but my business revenue went happily up once I had removed the self-imposed ceiling to my business growth. I was no longer tripping up over all the VAT stories I had been telling myself.

Choice 3: Play the long game and take control over when you are registering for VAT

This is the choice I wished I had made; knowing that I was going to have to register for VAT at some point in the next year, I ought to have picked a date in the future and planned my business growth strategy and marketing campaigns around it.

Here are some of the opportunities that you may have:

- Plan the VAT around your next price increase. All good businesses increase their prices at some point; to not only keep up with inflation and market rates, but also how you are positioning yourself and the clients you are attracting more of.

- If you are working with consumers who can’t claim the VAT back, make your prices VAT inclusive; you don’t need to make the fact that you are now VAT registered a big story so don’t overcomplicate the buying decisions your clients have to make.

- You could take the other approach and make the fact that you are now VAT registered a celebration; it’s a sign of your success and the fact that you are now contributing value to the economy. Choose your messaging carefully though, as your clients have to feel part of your success, rather than now feel they’ve been negatively affected.

- Announce price increases well in advance; I’d recommend between 3 and 6 months. The more notice your clients have, the less likely they will have a grievance with you. They will appreciate your communication and professionalism.

- Increase your prices for new clients only and take the VAT hit with your existing clients. This approach needs to be worked out carefully, making sure you can afford to do this, but grandfathering your existing clients (the provision in which an old rule continues to apply to some existing situations while a new rule will apply to all future cases) could be a smart move to keep your client base loyal, and a thank you for supporting you over the past few years.

Depending on your business model and marketplace, you may have other ideas. The important thing to remember though is when you are able to take control of when you become VAT registered, suddenly you have an amazing opportunity to step up your business to the next level of growth.

If you’ve been struggling with the thought of VAT registration and the fear of losing clients by having to put your prices up, how has this landed with you? Your personal beliefs around money create a lot of energy – positive and negative – around what you take action on to grow your income potential. And VAT registration can be a big emotional trap for many business owners, so you are not alone.

I’d love to know your thoughts. Please leave a comment below.

Until next time, do less, be more, play bigger.

by Karen Skidmore | 11,21 | Business Planning, Pillar Articles

Have you wondered why you are not making the progress that you thought you ought to be making by now? It doesn’t matter how much harder your work, how many more hours you put in or what money you throw at your marketing, there comes a point where your growth gets stuck.

It happens to every business; it’s not just you!

There is a misconception that business growth has two stages; launch and grow. You successfully launch a new business or product, and then set on growing your business by finding more clients to increase your revenue.

But over time, the growth phase slows down; you start to plateau.

For some, you may have two or three high revenue months. But the months between aren’t and this is where the infamous feast and famine roller coaster starts to kick in, and you don’t seem to manage to get the growth that you had in previous years.

It doesn’t matter what you do or what new marketing initiative you put into place, when you look back on your financial accounts over the past few years, your business has bumped along at the same revenue.

Why?

When you are selling your time and/or expertise, you will eventually run out of capacity or energy. Or worse, you run out of both at the same time and you get on the fast track to burn out as you can’t keep up the delivery of what you are selling.

The Shirlaws Group carried out some fascinating research several years ago. They interviewed more than 700 businesses to discover that there are predictable ‘black holes’; key turnover figures where businesses get stuck because they don’t see where they have to shift strategies to get through them.

When I started to apply this ‘black hole’ research to the businesses that I’ve been working with over the past years, I began to see the same patterns at lower turnover figures.

You get stuck because you aren’t switching up your strategy to reflect the next level of growth.

Essentially, what got you here, won’t get you there.

Here are the three ceiling incomes your business will predictably get stuck at, and what you can do to shift your thinking and strategy to move through each one.

The Freelancer Ceiling – £45K

At around £4K monthly sales, there’s a very good chance you get stuck under The Freelancer Ceiling. You are selling your time either by the hour or have created a number of low priced courses or programmes.

Even though you may be getting recommendations through word of mouth, you haven’t worked out your marketing well enough to have a consistent flow of new clients, and you start each month wondering where your money is going to come from. Although you are working hard to keep your spirits up, you are running out of marketing ideas and energy.

To move beyond the Freelancer Ceiling you have to shift out of Freelancer Mindset, and start adopting a Business Owner Mindset. It’s time to change up your thinking, strategy and evaluate how good your services and products are, how well you are communicating that to your potential audience, and shift your client working relationship to be one of partnership.

You have to start outsourcing the stuff that is frankly below your pay grade; it’s time to release tasks such as diary management, proposal writing, invoicing and client onboarding. So if you haven’t hired your first admin support or virtual assistant, now is the time to do so.

It’s also time to evaluate the boundaries you’ve set with your clients to ensure you aren’t over-delivering or under-charging (often both!).

And finally, you want to be able to free up some of your time to develop your intellectual capital, such as your process and framework of working with clients, marketing collateral, such as brochures and videos, and credibility proof, such as case studies and keynote speaking.

This may sound like a lot, but over a course of a year, you will surprise yourself how much you can get done with the right plan in place. And all this will give you the strong foundations for your next growth phase, and help you get off the busy, always-be-marketing hamster wheel.

The VAT Ceiling – £80K

The next plateau happens at around £80K; the revenue that all businesses need to register for VAT. If you’ve already registered your business for VAT when you first started, then you may not get stuck here for long. But for those of you who have waited to register your business until now, then I’m afraid the mental block can hit you hard.

On one hand, this is simple compliance. Your business has been deemed to be contributing to the economy so it’s time to charge Value Added Tax; a phase that ought to be celebrated by all.

However, the emotional head games begin and you start to worry about having to increase your prices by 20%, especially if you are selling to consumers rather than other VAT registered businesses. I got myself stuck under this ceiling for more than three years before I finally took the plunge and got registered for VAT. A painless process in the end and funnily enough my business revenue went happily up once I had removed the self-imposed ceiling to my business growth.

But moving past this ceiling is much more than just registering yourself for VAT. If you’ve done the work as above to establish yourself in the marketplace, you’ve hopefully created a good suite of offers that sell well, your marketing is working and you are starting to have regular periods of £10K months.

To increase your revenue further into a 6 figure business, your Business Owner Mindset needs to shift into CEO Mindset; it’s not just about marketing yourself harder but developing a longer term game plan and being more strategic about what you want out of your business.

If you don’t realise this, you become the bottleneck. This phase of your business growth needs you to shift your focus from marketing, selling and delivering, to putting in the right process, systems and people in place to support your growth.

It’s time to start putting your energy into HOW your business is run; what and who is needed to support your growth. You need to ask yourself whether you’ve got the right business model in place to scale up and whether your branding – your positioning, website and social profiles – are reflecting the business you are becoming. And you have to be sure you are working with the right partners and hiring the right people for your future success, rather than what you need help with today.

The Capacity Ceiling – £200K

As you sell more and your revenue creeps up to the £200K mark, there comes a point that whatever it is you are selling, you’re running out of capacity; time and energy.

Trainers, coaches and consultants can comfortably sell £150K to £250K worth of services and programmes with a small support team. But the bigger the contracts or the more programmes you sell, the less of you there is to go round your clients. The dynamics of your working relationship starts to change and there’s every chance you are feeling stretched, and your clients don’t feel they are getting the value that they may once had when you were a smaller business.

Your business starts to feel like project management hell, you begin to drop some balls and you don’t get the chance to catch your breath or take the time out to work on your own development.

You start forgetting about the importance of your CEO Mindset and spending time working on the projects to support your business structure and processes, and you become a busy freelancer again, simply at a higher revenue.

If you want to grow beyond this point, then this is the phase where you stop treating your business as something you do, and start getting clear about who you want to become; the role you want to play, the impact you want to make and your bigger vision.

Do you want to keep things simple and decide that you like what you do but you want to work less hours and reduce your stress; increase your profitability and still have Fridays off and longer holidays?

Do you have ambitions to grow a team so that you pull back on the actual delivery to either outsource the work or recruit associates; to run an agency or consultancy that you may want to sell one day?

This is the time for you to switch your business model to a well-oiled exclusive boutique business with a waiting list, a scalable digital or training model, or create a team of mini-mes; associates, licenced practitioners, franchisers or employed consultants.

It’s worth bearing in mind that a good business growth strategy doesn’t come in one size fits all, hence why you have to adopt a CEO Mindset and start spending time working on yourself, not just on the business. It’s important to dig deep into what it is you REALLY want out of your business and life, make decisions on where to focus your time and energy, and re-evaluate who you hang out with as you move up a league in your development.

So, it’s really not your fault that your business may be plateauing; you couldn’t be working harder than you are already. But hopefully now you may see what shifts in your thinking and strategy need to take place at different revenues.

If you want to dive deeper into this, then I highly recommend you join me for my next Ignite event where we spend the day together working on where you are in your growth journey and what shifts you need to take to make your onward journey a success.

Thank you for reading. Until next time, do less, be more, play bigger.

by Karen Skidmore | 03,21 | Business Planning, Stories, inspirations & thoughts for the day

This time last year, life, as we knew it, changed.

As I sit here and reflect over the past year, and of course acknowledge the trauma that happened to so many, I am also in awe by how many people have shifted and grown their businesses.

Comfort and growth can’t co-exist.

It often takes extreme discomfort for us to make big changes to how we are living and working. And for all the grief and loss that many have encountered, there are many others who have risen up, like a phoenix from the ashes.

I think of all the new experiences that I have bought that I would have never considered before March last year.

Joining fitness classes over zoom is probably something we’ve all done for the first time this past year. But now some fitness professionals are going further and making decisions to staying online; they’ve realised they are now open for a global market (time zones dependant) and have upped their tech skills to have a full TV production suite in their home studios.

This month I booked a magician for my son’s 19th birthday (never too old for a magician, yes!) through an Airbnb experience. An hour’s private show beamed straight to my laptop from a chap over in Japan; it was 4am for him! He told us that his day job was a project manager and in June last year he decided it was time to turn his hobby into his career. He now runs between 3 and 5 shows every few days, to an audience across the world, and is regularly booked for corporate events, as well as families like us.

And last week, I had a virtual photo shoot. Yes … a professional photo shoot through an app that I downloaded on my phone. I was a little sceptical about this but if you are on Instagram, you can see the results on my profile @karenskidmore. I was blown away by the quality of photos and how good Aga was at directing me by only using her voice.

What about me? What new skills and ways of doing business have I adopted?

I’ve always worked predominately online, so working on zoom wasn’t new to me. But I have had to learn how to run my all day workshops virtually, as well as our Mastermind Days for our Momentum Impact members. I’ve decided these work better online – more powerful – and I won’t be travelling into London to run these again, something I would have never considered before last year.

I’m also now working in my Plotting Shed, a new garden office that we built at the end of last year. With my husband now working from home, it became apparent we needed two separate offices. Of course, I volunteered to go outside. And I love it. (Again, you can go see what it looks like on my Insta pics.) It is the most gorgeous space and it makes me smile every time I walk down the garden path to unlock the door each morning.

Would any of these examples that I’ve shared here have happened without the discomfort of the last year?

Absolutely no.

This past year has pushed many of us to our extreme boundaries. We’ve been forced to step outside of our comfort zones and face, head on, parts (or even everything) about our business that stop working suddenly twelve months ago. You’ve made decisions about where and how to move your business through these last twelve months and, whatever has happened, there’s every chance your business is very different from where it was a year ago.

Acknowledge what you’ve achieved in your business through these uncomfortable months. And know that the potential of what is possible happens because you don’t stay comfortable.

Which leads me to wonder how we can all make sure we take full advantage of a little (or a lot of!) discomfort from time to time so that we can keep moving forward and ensure we are thriving in business.

If you want to discuss what I’ve shared here today and you’re interested in being challenged in what you could achieve, get in touch.

Until next time, do less, be more, play bigger.

by Karen Skidmore | 03,21 | Business Planning, True Profit

Your business instinct is far stronger than you give it credit for.

However, if you are worn out and feeling frazzled (and hey, don’t we find ourselves at the end of our tethers most days right now!) it’s easy to find yourself fire-fighting your way through your business week.

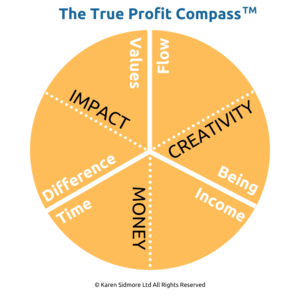

I want to give you an opportunity to recalibrate and define clearly what it is you need from your business to enable you to grow. In my book, True Profit Business, I teach a model for growth that at its core has something I call The True Profit Compass.

A compass is an instrument used for navigation, but it doesn’t tell you which direction to go in. It aligns you to your magnetic north so you can orientate yourself before deciding where to do next.

A compass is an instrument used for navigation, but it doesn’t tell you which direction to go in. It aligns you to your magnetic north so you can orientate yourself before deciding where to do next.

The True Profit Compass works exactly like this. It aligns you to your magnetic north – your business instinct – and helps you make decisions to design and run your business to serve you, rather than burn you out.

There are three energies at play in this compass; money, impact and creativity. And it’s money that I want to focus on with you today. Although money may not be your core driving motivator for growing your business, there’s no doubt you have a need for money coming in.

I look at money being split into two sections: the time and income needed to help you flourish.

Your time is a limited resource, which often goes unchecked and undervalued. It’s important you consider what boundaries you want to set, and the systems and business model needed to give you the time that you want.

For income you may not need much income for day-to-day living. However, I don’t know many people who started their own business to just ‘get by’ so let’s get you clear on what you need, as well as the amount you want to fulfil your wealth goals and life plan. Plus if you plan to grow, you will absolutely need money for investment in your business growth and expansion (hiring people, putting in systems & marketing budget) so you have to consider how big a business you really want to have one day.

Let’s dive into each one and give you a framework in order to work out what time and income is best for you.

Your time

What hours are you prepared to work?

Very few clients that I’ve worked with over the years have stopped to think how their ideal week or month could look; they have often allowed their business week to be shaped by what their business gives them. If you could reset your work schedule for six months from now, how would it look; how would you spend your time, what hours would you work and which days would you take off?

What is your capacity and availability for taking on new clients or selling new programmes?

I often hear business owners asking for more clients, but they haven’t stopped to consider how many clients would give them a ‘full’ business. Think of your business like a hotel booking sheet. A hotel will have a finite number of rooms to sell for every day of the week. No matter what you sell, you will find there will be an optimum level of clients or products or programmes you can sell, whilst still maintaining the level of service you want to give.

If you choose to maximise your sales and compete on price, you are going to find this a tough marketing strategy; competition is going to be tight and you have to ensure you have the distribution channels or delivery systems in place to keep up with the demand. For most of you reading this, you will have better success in thinking in terms of optimising your sales and deciding how many clients or customers you can serve in any one week, month or programme.

By doing your sales numbers this way, you can work your charge rates and prices back from here once you’ve decided how much you want to earn.

What are you not prepared to sacrifice?

- Are your Fridays sacred?

- Do you have to pick up children every day at 3.30pm?

- Are you happy to work during the weekends but you want two days off during the week?

- Do you always want to have July and August off?

Decide what time you aren’t prepared to give away so you can set those boundaries in place now and avoid frustration or resentment at a later date.

What changes do you want to make in the future to the way you spend your time now?

For some of you, making changes to your current schedule may not be feasible. If you are booked up with work for the next few months, run a busy clinic or see clients in a regular time slot every week or month, then you may need to look at your diary for three or four months hence.

If you want to move your diary schedule around in the future, what will it look like and when do you want to do it? And I’d recommend blocking out this time now before you find yourself filling it with more client work!

Your income

I avoid asking my clients to decide how much money you think your business can or should make. When setting money goals, it’s often your ego that makes these decisions because of external influences; it’s important to be inspired but if all you see, read or hear is success defined by six or seven figures, then this will have an influence on when you believe your business will be successful. What I want you to do here is take a more inward approach to how much income you need and want to make from your business.

Let me share a story about a client I recently worked; she came to me with a financial target of £100,000. But once we worked out how much she needed to live on, how much she wanted to invest in her business and how many clients she actually wanted to work with at any one point, it turned out she didn’t need to stretch herself to find £100,000 in sales over the next year; her actual financial target was only £65,000.

This was her third year in business and, although she had achieved great things, she was exhausted by selling too many low-priced programmes and dealing with a 6,000 strong Facebook community. Once we had worked out her income streams, simplified her products and programmes to give her less to sell, and mapped out her marketing campaigns for the year ahead, she was visibly more relaxed; she had far less to do than she thought she’d end up with.

It turned out that the initial financial target of £100,000 came from the pressure she had been putting on herself to be seen as successful by her peer group, and if I’d been focused on helping her achieve her original six-figure target, she would have ended up burnt out and putting in the wrong growth strategy.

She still wanted to grow a six-figure business at some point, but her growth strategy for the next year was about simplifying and restructuring her business model so she had a stronger and more sustainable foundation from which to build on in the following two years.

This is why it’s important to know your financial needs right now, as well as what you want to achieve, and keep reviewing them as you grow. Don’t chase figures based on what you think is expected of you or your business.

How much income do you need right now?

If you haven’t done so already, you need to work this out. Not in your head; sit down with your bank statements, your bills and a calculator. If you are living with someone else, this may be a joint conversation. If you need to get a grip on your credit card debt or long-term savings plans, get help and speak to a financial advisor.

Too many business owners don’t know what they need to earn and are simply going about their sales on a wing and a prayer.

How much income do you want in the future?

Is there a savings pot you want to fill up? Have you got short- term savings you want to build for a holiday? Or perhaps longer-term savings for investing in a second property or pension? Again, get help from a financial advisor if you need to. Don’t wishfully think what you want; work out what that figure needs to be and over what time period you could work towards it.

What does your business need to sell to give you these income figures?

Once you’ve worked out your income figures, how does this translate into turnover figures? Remember, your income is different from profit (you have to pay tax), which is different from turnover (you have expenses). So once again, if you haven’t got these figures clear yet, work them out.

This money work is a big part of what we do in Momentum, our business growth programme. Yes, sales targets are set but without doing the work on what net/gross profit, business costs and forecasted income, you could be building a business on shifting sands; whatever growth in sales you get one quarter, disappear in the next because you haven’t got a solid money foundation in place.

What short-term ‘costs’ will give you long-term ‘gains’?

You may be in a period of growth in your business where your expenses are high because you are investing in new systems, processes or hiring team members. A lack of cashflow is what causes most businesses to fail, so rather than waiting to sell ‘enough’, do you need to seek external financing to fund your growth plan? If so, what options can you look at or how much do you need?

What now?

Working through this framework will help give you your magnetic north. You’ll find more about how to work through the energies of creativity and impact in my book, True Profit Business. But in terms of money, I hope that you can see how this can help stop you chasing pie-in-the-sky figures that are often fed to us by what we see on our social feeds, and now have realistic and sustainable figures to work towards, whilst still giving you opportunities to stretch.

Money pressures can break us.

And when we don’t give ourselves this opportunity of spending time to fuel our business instinct and working on our navigations from our True Profit Compass, we end up exhausting ourselves. Burn out is not a rite of passage to success … you can design your business to work FOR you and what it is you want out of life.

Until next time, do less, be more and play bigger.

A compass is an instrument used for navigation, but it doesn’t tell you which direction to go in. It aligns you to your magnetic north so you can orientate yourself before deciding where to do next.

A compass is an instrument used for navigation, but it doesn’t tell you which direction to go in. It aligns you to your magnetic north so you can orientate yourself before deciding where to do next.