The problem with selling services, such as coaching, advice and consulting time, is that it’s very easy to get caught up with how much you ought to be charging. Emotional stories such as “I’m not that worth that much” or “There’s no way my clients will pay that” whip you up into a storm at times, and you can spend days, if not weeks, agonising over the price of your next proposal or new programme.

When you’re selling your time and expertise, you have a low cost of sales, which means you don’t have to spend that much each month to be able to do what it is you that you do. So your prices are often based on how much you feel you can charge.

Although I am a big fan of trusting your intuition in business, emotional feelings are not good commercial indicators, especially if you are working hard to find enough clients each month and you may be coming from a place of worry or anxiety over where your next piece of business is coming from.

What if you could have a simple pricing formula to ensure the prices you charge, give you the income that you want at the end of each month?

There are a number of ways of calculating prices.

Cost based pricing; good for physical products, but not so good for services because of the very low costs involved, particularly if you work virtually and don’t have any office or clinic space.

Value based pricing; typically used for services, but because of the emotional stories, very few service professionals allow them to charge enough and so end up using the next method.

Market based pricing; set your prices based on what everyone else in your market place is doing. The problem with this method is that the only way to ‘win’ at this one is to be the cheapest. Customers will typically use price as the deciding factor when choosing you and you get trapped into having to work harder by having to work with more clients. It’s like putting your next proposal or new programme on Amazon marketplace and just hoping you come out on top of the searches.

There’s a fourth method and that is income based pricing; charge the price that gives you the income you want. And this is what I wanted to demonstrate in this article.

Before I dive in, I have a few caveats.

1) I’m over-simplifying the figures in this article to make it easy for me to share examples. Do you own finance work and costings to make sure it stacks up for your own business.

2) The kinds of businesses that this can work for are usually service providers, such as consultants, coaches, accountants and therapists, because operating costs are usually very low for these kinds of businesses, particularly if you are working virtually and have no office or clinic space.

3) What I am sharing here is not professional accountancy or finance advice. I am not a qualified finance advisor so do seek proper tax and accountancy advice from your own accountant.

4) In my working examples below, I write about monthly revenue. For most businesses, your revenue ebbs and flows. Sometimes people refer to this feast and famine, but in my experience, there is always a natural cycle of a few months of harvest and a month here and there of letting your fields go fallow. So don’t get hung up on the fact that a monthly income needs to be consistent to be successful, because consistent income is one of those holy grails that marketers sell you, but isn’t always easily achievable! It’s how you manage your manage your money during the harvest months that allow you enjoy the fallow months that matters.

How you may be using your income reports right now

For most people, you hire an accountant or bookkeeper to keep track of your finances, and at the end of each year, your accountant hands you your end of year accounts. This is when you find out exactly how profitable you were over the last year, how much tax you now need to pay and how much you’ve actually earned.

There are two problems to this approach. One, you may end up being very disappointed by the final figures, wondering where all your money went after working hard all year. If you’ve not been on top of your finances during the year, this is also where you may find that you’ve not put aside enough tax. This happened to me in my early years; it’s not a nice feeling!

Two, your tax returns and company accounts aren’t really designed for your business use. Tax returns and statutory accounts are legal requirements to let the Inland Revenue know how much tax you have to pay. As day-to-day tools to help you manage your business, they are pretty useless. Some business owners will have accountants who help them with management accounts each month, but for most, they are still too clunky to be use them to help decide on what their pricing ought to be.

You need a simple pricing formula that you can use to quickly and easily price up proposals and programmes.

The Profitability Sweet Spot

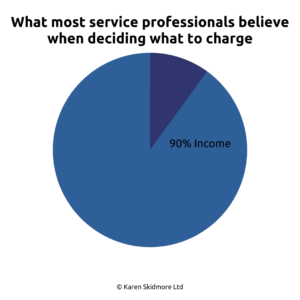

If you are like most service based business owners, there’s every chance that you allow yourself to think that whatever you charge your clients, is what you get as income, minus a few expenses and a little bit of tax.

Thus if you charge a client £1000, you may think in your head that your income is about £900, give or take. If you have been trading for several years, this may be why you feel deflated at the end of each year when your accountant hands you your tax returns, and you realise you ended up making very little money. This can often trigger those thoughts that you aren’t working hard enough and thus you keep on the crazy ‘work harder’ hamster wheel.

Here’s how I look at a business’ finances, and how I use them to help them with my pricing.

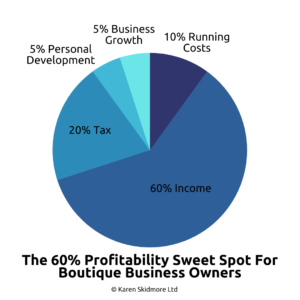

There are four main areas that your revenue needs to go towards, apart from your personal income; tax, running costs, business growth and personal development.

Let’s go through each one.

- 20% Tax. You only pay tax on your profits, rather than revenue, and there are different tax rates depending on your overall income, including personal tax and corporation tax, if you are a limited company. This is why I make the caveat above about over-simplifying. I am not a tax accountant and nor do I want to be working out my own tax each year. But I do want to include a percentage of tax in my pricing to ensure I am being paid the money I want in my personal bank account. 20% is often slightly higher than it needs to be, but I always work to have more money in my tax account rather than risk having a short fall and not being able to pay my tax on time. Anything extra left in my tax account after I’ve paid my taxes I see as a great way of saving, so it’s a win win in my opinion.

- 10% running costs. Of course, this is going to vary depending on your business, which is why you have to get clear on exactly what you spend each month. But over the years of working with many consultants and service businesses, this figure is a good average to work from to get started. This percentage needs to cover everything from internet services and website hosting, to admin support and insurance.

- 5% business growth. Your business needs income, too. You may need ad hoc technical support, or need to invest in a new website, images or brochure design. Having this percentage ensures you have the cash to build up a buffer to pay for what you need, when you need it. Too often small businesses like yours struggle to invest, particularly as they start to scale up and grow, because they are trying to pay for things like new websites or branding out of cash that month, and that’s never easy to do.

- 5% personal development. Investing in yourself is critical as a business owner. Yes, this may cover the obvious such as coaching or mentoring, but you may also want to invest in CPD training or keep yourself up to date with the latest industry trends or attend a conference. Again, like business growth, people often try to pay for these things out of cash that month and if you struggle to have enough money, you forgo what is needed to develop yourself, both personally and professionally.

So the profitability sweet spot becomes 60%, which means for every £600 you want to earn, you need to sell £1000 to get that income.

Or let’s put it another way, for every £1,000 you sell, your true income is just £600. How does this make you think about your prices?

Now that you know you need 40% of everything you sell to go towards tax, running costs, business growth and personal development, can see why you have to charge better than most of your competitors.

Let me give you some working examples.

Example #1 Freelancer wants an income of £2,000 a month so needs to sell £40,000 of services a year

20% Tax: £8,000

10% Running Costs: £4,000

5% Business Growth: £2,000

5% Personal Development: £2,000

60% Personal Income (Profitability): £24,000

To sell £40,000 of services in the year, your monthly revenue needs to be £3,300. And if you work with five clients during the month, they each need to be spending £660 with you each month. Thus, £40,000 divided by 12 months = £3,300 divided by 5 clients = £660

Example #2 Consultant wants an income of £6,000 a month so needs to sell £120,000 of services a year

20% Tax: £24,000

10% Running Costs: £12,000

5% Business Growth: £6,000

5% Personal Development: £6,000

60% Personal Income (Profitability): £72,000

To sell £120,000 of services in the year, your monthly revenue needs to be £10,000. How this breaks down per client will depend on your business model but if you are predominately working with as a consultant, then this may look like five clients a month need to spend £2,000 a month with you.

If you sell group programmes, then maybe you need to be selling ten places at £1,000 a month. Or if you sell longer term contracts, such as training or consulting, then that may be ten clients over the year that all need to spend a minimum of £12,000 each.

What will typically happen with a business this size is that you will have a few different revenue streams, and your revenue will often ebb and flow over the year, as highlighted above in my caveats. But it never needs to be complicated.

If you struggle working this through with a business this size, then reach out to me. I do this work with my clients all the time so it’s easy for me to show you what your revenue model could look like with the right prices in place.

What if you are running at a higher profitability than 60%

What if you are genuinely paying yourself far more than 60% of your revenue each year? If it’s working for you, then great. You don’t have to be putting aside 5% for business growth and 5% for personal development, for example. And you may find your running costs are less than 5% over the year.

But there are two profitability danger spots you need to look out for.

Swinging into 80% or more

If you are swinging towards 80% profitability and above, and earning £800 for every £1,000 you sell, then there is a danger of your business being under-invested and under-resourced.

In the short-term, this may work. Enjoy the fruits of your labour!

But long-term, you may find yourself burning out, particularly if you are in the higher revenue bracket as seen in example #2. If you run a business with a revenue of £100,000 and more, then there is every chance you need a good operations person, and perhaps even start looking at hiring associates if you are in high growth phase, so it may mean you aren’t spending enough to give you the team, processes and systems to support you in your work.

You are working hard at doing everything yourself, and although this can work in the short term, over many months and years, your health and wellbeing is going to suffer trying to keep up with delivery work, as well as what it takes to sell and support you and your clients.

Swinging into 40% or less

If you are swinging towards the 40% profitability and lower, and earning less than £400 for every £1,000 you sell, then there is a danger of your business being over-invested and under-resourced.

In the short-term, this may be necessary; you may be going through an intense period of growth and hiring new members of your team whilst the revenues go up. Hang in there if this is the case, and stay strong with your vision.

But long-term, you may find yourself over-spending and if there is one guaranteed way of a business going under is a lack of cash.

One area I often see being over-spent is personal development; high priced coaching programmes and getting sucked into big marketing programmes can often put a business owner into a cash flow crisis, especially if you are using a credit card to finance.

The other area is hiring too many people, especially if you have decided to run a big launch or you are developing the digital marketing side of your business. You want to have a tight rein on your finances and ensure that whoever you are hiring have clear ROI targets and know what is expected of them.

So watch out for these two swings in both directions. Over the many years of working with consultants, agencies and service professionals, the sweet spot for your personal income happens around 60%, whilst ensuring 40% of whatever you sell goes into your tax, running costs, business growth and personal development pots.

How does this help with your pricing decisions? Let me know what you put into place and what impact this has on your business.

Until next time, do less, be more, play bigger.